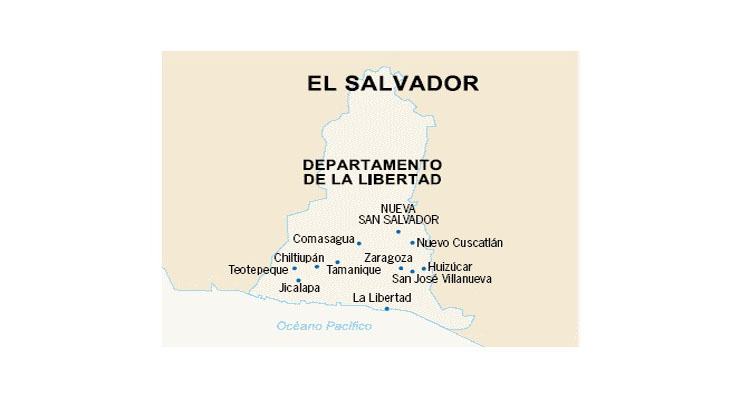

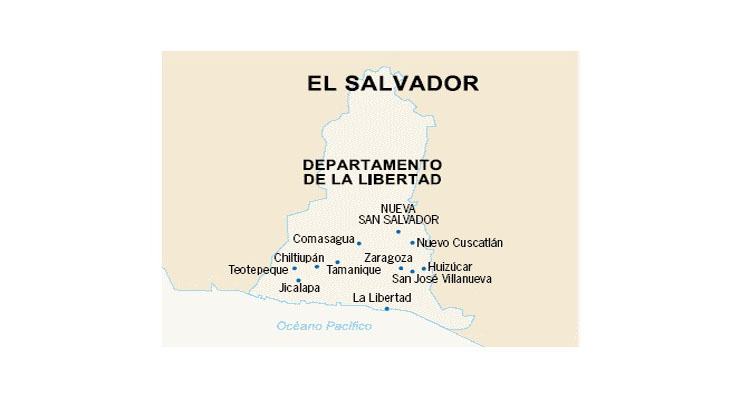

The project will be developed between the Stations 15+800 until the Station 21+300 in the CA04S road. The total longitude of the assignment consists of 9.5 km and involves the extension of the existent road CA04S, that currently contains only 1 lane in each direction. It will be improved with 4 lanes of 3.50m wide each (two in each direction).

This expansion will allow the connection between diverse communities, cantons, properties and important neighborhoods access.

Deadline for submission of bids: February 4, 2017.

Estimated cost of investment: USD 24 million

Julio Vargas Solano

Julio Vargas Solano

Managing Partner

García & Bodán

El Salvador

Julio Vargas Solano

Managing Partner

García & Bodán

El Salvador

Julio Vargas Solano

Managing Partner

García & Bodán

El Salvador

Julio Vargas Solano

Managing Partner

García & Bodán

El Salvador

Julio Vargas Solano

Managing Partner

García & Bodán

El Salvador